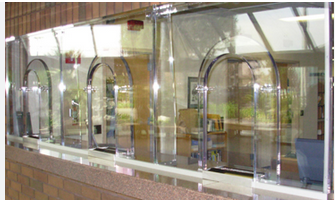

In relation to financial, the teller window is an essential area of the process. Clients depend on tellers to handle their purchases, and banking companies depend upon effective tellers to have their cashier’s tray procedures working efficiently. But exactly what makes the teller window this sort of essential component of a bank’s good results? On this page, we’ll explore the necessity of productivity with the teller windowpane and the way banking companies can maximize their teller approach.

Streamlining the Transaction Approach: In terms of managing purchases, pace and precision are crucial. Clients have to get inside and outside of the financial institution quickly because of their deals done correctly. Banks that optimize their teller window procedures provides faster service to their clientele, reducing wait around occasions, and enhancing all round customer happiness. By streamlining the transaction procedure, tellers can serve much more buyers and transfer outlines easier.

Electronic Alteration: As technological innovation will continue to progress, banking institutions are looking for ways to digitize their operations and reduce the reliance upon pieces of paper-structured transactions. Implementing digital solutions like funds recyclers, electronic signatures, and programmed teller equipment may help decrease money managing and enhance total effectiveness. These options also can release tellers’ some time and let them concentrate on more advanced buyer needs, for example economic guidance and appointment.

Instruction and Assistance: To optimize productivity at the teller home window, it’s essential to have well-skilled tellers. Teller coaching should protect from deal coping with to customer satisfaction skills. Banking institutions should likewise give tellers with continuing help, like training and satisfaction feedback, to help them increase their abilities and remain active. A nicely-skilled and motivated teller staff are prepared for higher quantities of transactions successfully.

Customer Service: The teller home window is often the initial reason for contact between a lender as well as its customers. As a result, it’s crucial to offer exceptional customer support constantly. This includes everything from greeting consumers using a grin to managing purchases efficiently and correctly. Banks that prioritize customer satisfaction on the teller windows will create much stronger connections making use of their customers, improving preservation and commitment.

Data and Analytics: Banking companies gain access to huge amounts of info, and utilizing that information will help improve the teller windowpane process. By monitoring deal quantities, hold out instances, and teller performance, banks can recognize bottlenecks and places for development. Using this type of info, banks can adjust staffing levels, instruction courses, and technology solutions to improve performance on the teller windows.

Simply speaking:

The teller window might appear to be a little area of the banking process, but it performs an important role within the all round success of your financial institution. By improving the teller windowpane method through streamlining deals, computerized alteration, personnel coaching, customer service focus, and data analytics can lead to improved client satisfaction, greater deal volume level, and finally, a booming business banking enterprise. Banking companies that prioritize productivity at the teller windows will likely be much better positioned to conditions any storms that could arrive their way later on.